The banking revolution in Europe was well underway. Challenger banks were disrupting traditional institutions, pushing them to either adapt or risk losing their market share. ING recognised an opportunity to bring this transformation to Asia, specifically targeting the Philippines and China, where traditional banking was still slow, outdated, and heavily reliant on in-person interactions.

I was brought in to scale the team, refine the product, and ensure a seamless multi-lingual banking experience across platforms. My role covered:

What started in the Philippines quickly expanded, leading me to fix design inefficiencies in China, ensuring the product’s success in multiple markets.

Building a great digital banking experience required more than just technical excellence—it needed a deep understanding of how real people managed their money. Banking habits in the Philippines and China were vastly different from those in Europe and the UK, meaning traditional Western UX patterns wouldn’t always apply.

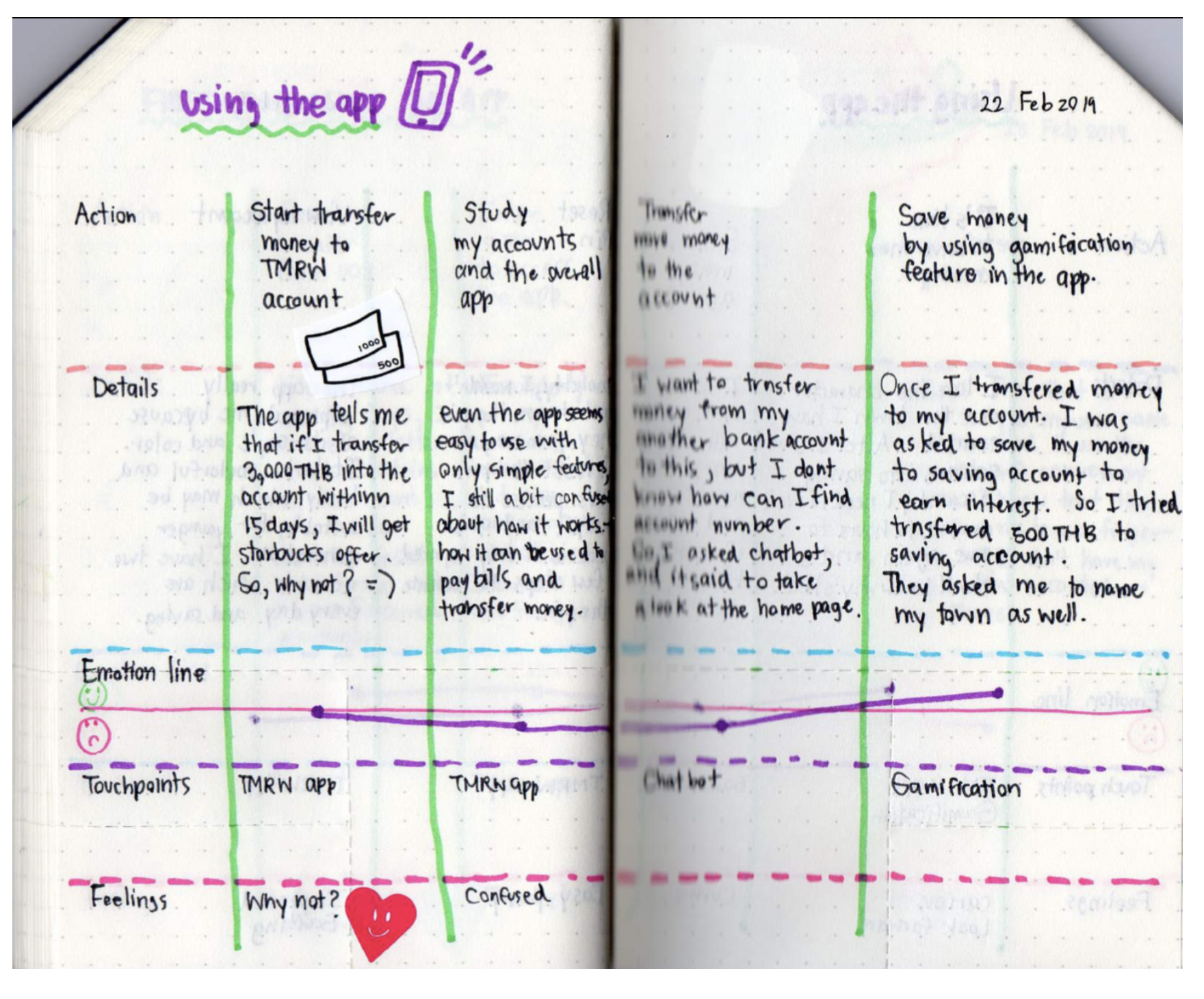

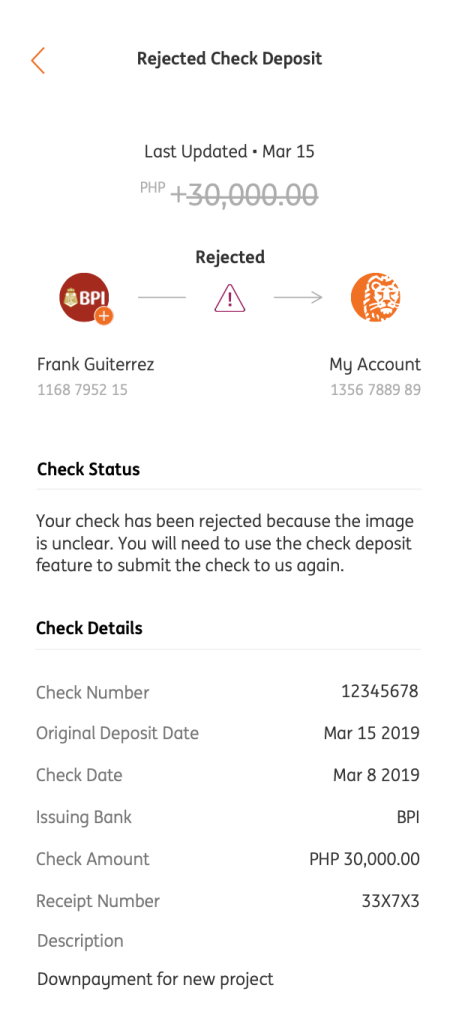

To ensure the product was truly user-centric, I led a multi-pronged research strategy that included:

These insights directly influenced feature development and UX refinements, ensuring ING’s banking experience was tailored to real customer needs, not just assumptions.

Scaling a team in the Philippines required more than just hiring skilled professionals—it required an understanding of cultural differences, work styles, and values that were very different from the UK and Europe.

Whereas UK workplaces tend to be hierarchical and fast-moving, Filipino work culture values consensus, mentorship, and personal relationships. Leadership isn’t about simply giving directives; it’s about building trust, ensuring respect, and creating an environment where collaboration feels natural.

To navigate these differences, I spent significant time outside of work with my colleagues, learning about their backgrounds, professional expectations, and broader cultural influences. These insights allowed me to:

This human-first leadership approach led to stronger team cohesion, higher retention, and a team that was fully invested in ING’s success.

After successfully growing ING’s design presence in the Philippines, I was brought in to fix design inefficiencies in China, where slow processes were delaying product releases.

The biggest challenge was design debt—workflows were outdated, inconsistencies were common, and the design team was acting as a bottleneck for development. In just a few weeks, I was able to:

These changes ensured that ING’s digital banking experience remained high-quality, scalable, and competitive across multiple markets.

This project reinforced essential lessons about scaling design in complex, highly regulated industries.

If you’re looking to scale a high-performing design team, improve digital products, or transform your UX strategy, let’s chat.